Updates on the Parliament Budget Session Live

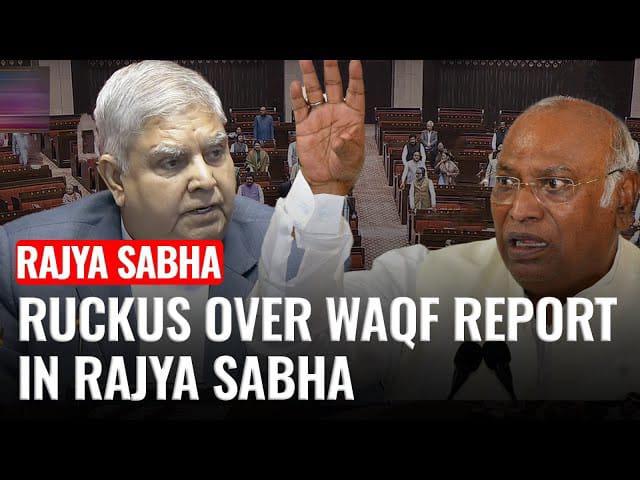

Following the Rajya Sabha’s presentation of the Joint Parliamentary Committee’s (JPC) report on the Waqf (Amendment) Bill, opposition leader Mallikarjun Kharge asserted that the report had been cleared of the dissenting remarks. Vice President Jagdeep Dhankhar was pushed by Kharge to reject and return the report, calling it undemocratic and deplorable.

On January 30, the JPC panel—which included both BJP and opposition MPs—presented its findings to Speaker of the Lok Sabha Om Birla. With a majority of 15 to 11, the committee gave its approval to the report on the proposed law.. Members of the BJP emphasized that the measure, which was presented to the Lok Sabha in August of last year, intends to modernize, make Waqf property management more transparent, and increase accountability. However, the opposition argues that this bill undermines the fundamental rights of the Muslim community and disrupts the functioning of Waqf boards.

Meanwhile, Union Finance Minister Nirmala Sitharaman is set to present a new Income Tax Bill in the Lok Sabha. This bill will replace the existing Income Tax Act, which has been in place for over 60 years, and is expected to come into effect from April 1, 2026.

Experts think the new law is primarily a simplification exercise because it does not contain any significant fundamental changes. Clear language, the elimination of extra clauses and justifications, and a more expansive definition of income are some of its salient features. The new Income Tax Bill counts virtual digital assets as part of a taxpayer’s capital assets and incorporates them into the definition of property. Furthermore, a lot of provisions are now shown in tabular form.